la county tax collector duplicate bill

Pay Your Property Taxes. Such evidence MUST contain the same name and address as printed on the warrant.

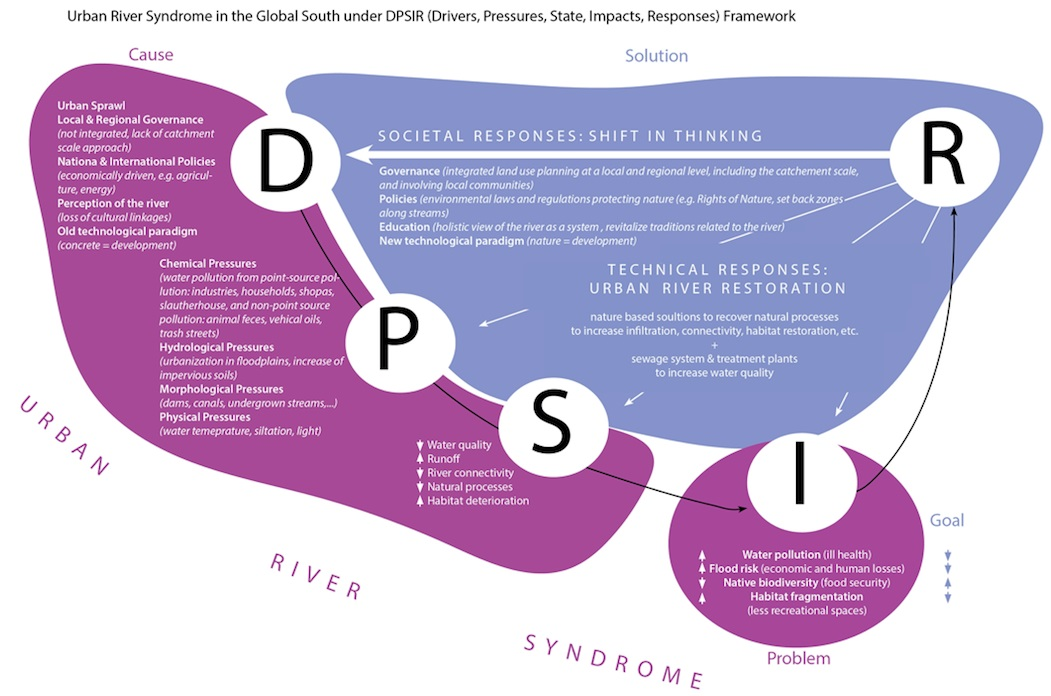

Sustainability Free Full Text Urban Stream And Wetland Restoration In The Global South A Dpsir Analysis Html

Please note that neither a Substitute Property Tax Bill nor an Adjusted Property Tax Bill can be accepted as proof of address.

. Nombre Impreso del vendedor 11. Request Duplicate Bill. Secure Power of Attorney for Motor Vehicle.

Notice of Delinquency - The Notice of Delinquency in accordance with California Revenue and Taxation Code Section 2621 reminds taxpayers that their property taxes are delinquent and will default on July 1. Adjusted Annual Secured Property Tax Bill. Pay Your Property Taxes.

Pay Your Property Taxes. Pay Your Property Taxes. If the delinquency date falls on a.

If payment is not received or United States Postal Service USPS postmarked by June 30 on July 1 a 15 redemption fee will be imposed and defaulted taxes will be subject. 1920013 or a county tax collector as defined in s. Los Angeles County Treasurer and Tax Collector and Director of Department of Consumer and Business Affairs Advise Landlords of Potential Relief From Impact of County Tenant Protections.

SEARCH BY TAX COLLECTOR REFERENCE NUMBER TCRef Number Eg. Property Tax Balance Due. We are accepting in-person online and mail-in property tax payments at this time.

Examples of such evidence include the following. Pacific Time on August 31You can make online payments 24 hours a day 7 days a week until 1159 pm. Los Angeles County Treasurer and Tax Collector and Director of Department of Consumer and Business Affairs Advise Landlords of Potential Relief From Impact of County Tenant Protections.

By clicking accept you are agreeing to our use of cookies. Assessor Auditor-Controller Treasurer and Tax Collector Assessment Appeals Board. Property Tax Balance Due.

Digital version at Internet Archive Ancestry. Nombre Impreso del vendedor segundario. Property Tax Balance Due.

Los Angeles County Treasurer and Tax Collector and Director of Department of Consumer and Business Affairs Advise Landlords of Potential Relief From Impact of County Tenant Protections. A county property appraiser as defined in s. Los Angeles County Treasurer and Tax Collector and Director of Department of Consumer and Business Affairs Advise Landlords of Potential Relief From Impact of County Tenant Protections.

This site uses cookies. Request for a Duplicate Instruction PermitDriver License. SEARCH BY TAX YEAR AND ASSESSMENT NUMBER.

Firma del vendedor 10. Property Tax Payment History. RefundsTax SalesTax Liens.

La eleccion de 5 o 6 digitos 6. Property Tax Balance Due. Lectura del odometro 7.

Partes que deben ser llenado por el COMPRADOR solo la siguiente manera. Secure Motor Vehicle Bill of Sale. To report an ADA accessibility issue request accessibility assistance regarding our website content or to request a specific electronic format please contact the office at 321 264-6930 or visit the Contact Us page to send an electronic message.

Justin Winsor The Memorial History of Boston Including Suffolk County Massachusetts 1630-1880 Boston 1880-1881 in 4 vols. Los Angeles County Treasurer and Tax Collector and Director of Department of Consumer and Business Affairs Advise Landlords of Potential Relief From Impact of County Tenant Protections. Pay Your Property Taxes.

FHL book 974461 H2wj v. Drivers license utility bill bank statement etc. Property Tax Balance Due.

Or films 1036727-1036728 with digital links. Fecha de lectura 8. LOS ANGELES COUNTY TAX COLLECTOR PO.

PayReviewPrint Property Tax Bill Related Information. Pay Your Property Taxes. Excluding Los Angeles County holidays.

The Los Angeles County Assessor establishes the assessed value of your property by appraising the value of that property under applicable State. You should also expect to receive either one or two separate supplemental bills which are in addition to your annual bill. Unsecured Property Tax Bill.

Property Tax Balance Due. Pursuant to California Revenue and Taxation Code Section 2922 Annual Unsecured Personal Property Taxes are due upon receipt of the Unsecured Property Tax Bill and become delinquent after 500 pm. Note the original bill may still have the prior owners name on it the first year.

La eleccion de un estado de real en exceso o No Actual 9. The County is committed to the health and well-being of the public. Property Tax Balance Due.

Pacific Time on the delinquency date. The Brevard County Tax Collectors Office is committed to ensuring website accessibility for people with disabilities. Pay Your Property Taxes.

Property Tax Balance Due. Los Angeles County Treasurer and Tax Collector and Director of Department of Consumer and Business Affairs Advise Landlords of Potential Relief From Impact of County Tenant Protections. Treasurer and Tax Collector.

Annual Secured Property Tax Bill The annual bill which includes the General Tax Levy Voted Indebtedness and Direct Assessments that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments. 1920014 who receives a written and notarized request for maintenance of the exemption pursuant to subparagraph 3. Los Angeles County Treasurer and Tax Collector and Director of Department of Consumer and Business Affairs Advise Landlords of Potential Relief From Impact of County Tenant Protections.

Los Angeles County Treasurer and Tax Collector and Director of Department of Consumer and Business Affairs Advise Landlords of Potential Relief From Impact of County Tenant Protections. Property Tax Balance Due. Must comply by removing the name of the individual with exempt status and the instrument number or Official Records book and.

Declaración jurada de la Ley de seguridad en carreteras y comunidades de Colorado CO-RCSA. Firma del vendedor segundario 12. Senior Citizen Property Tax Assistance.

You should not mail your payments to any other address. Property Tax Balance Due. Pay Your Property Taxes.

Also see Beacon Hill. Los Angeles County Treasurer and Tax Collector and Director of Department of Consumer and Business Affairs Advise Landlords of Potential Relief From Impact of County Tenant Protections. Pay Your Property Taxes.

Pay Your Property Taxes. If you do not receive the original bill by November 1 contact the County Tax Collector or Assessor for a duplicate bill. Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am.

Property Tax Balance Due. Request for Waiver -- Restrictions on Public Benefits. Los Angeles County Treasurer and Tax Collector Utility User Tax Unit co Mailroom Room 137B 500 West Temple Street.

Pay Your Property Taxes. BOX 54018 LOS ANGELES CA 90054-0018.

Metabeat Enters Global Market In Strategic Alliance With Crypto Com Nft

Property Tax Liens Treasurer And Tax Collector

History Truck Lettering Classic Cars Trucks Vintage Trucks

Property Tax Douglas County Tax

Chilton County Revenue Commissioner Chilton County Alabama

Chilton County Revenue Commissioner Chilton County Alabama

Changing Or Closing Your Business Los Angeles Office Of Finance

Logan County Treasurer Logan County

Property Taxes Lake County Tax Collector

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Property Taxes Lake County Tax Collector

Have Chinese Spies Infiltrated American Campuses The New Yorker

Property Taxes Brevard County Tax Collector

County Of San Francisco License And Certificate Of Marriage Signed By Mabel S Teng Marriage Signs California State Francisco